Business Succession and Estate Planning

Are You an Executor of An Estate? You Need Specialized Accounting Services

August 7, 2025

Building an estate takes a lifetime. Imagine how daunting it would be to wind up a person’s life work, settle all accounts, clear tax dues, and distribute the remaining estate to the beneficiaries. A well-planned estate, organized accounts, a detailed will, and a single beneficiary can make things easy. However, things get complicated if any of this is missing. Imagine a massive estate, significant debt, pending lawsuits, and multiple beneficiaries who are not on good terms with each other. Being an executor of such an estate can be a nightmare.

At times like these, you need a team of professionals who follow the law and standard procedure. They will account for every single penny so that you, the executor, are protected from allegations of mishandling the estate.

Roles and Responsibilities of an Estate’s Executor

As an executor, your real work begins after the death of the estate owner, and the process is daunting. However, you get paid for all the work from the estate’s earnings. Let’s look at your role as an executor at every step of the probate process.

Register the Death: The first step is to register the death of the estate owner with the appropriate provincial agency. Then, locate the latest will and determine if probate is required. A probate is not required if the estate is small or assets are held jointly in a trust, and banks and financial institutions waive the probate requirement. But if the estate is significant, a probate is required.

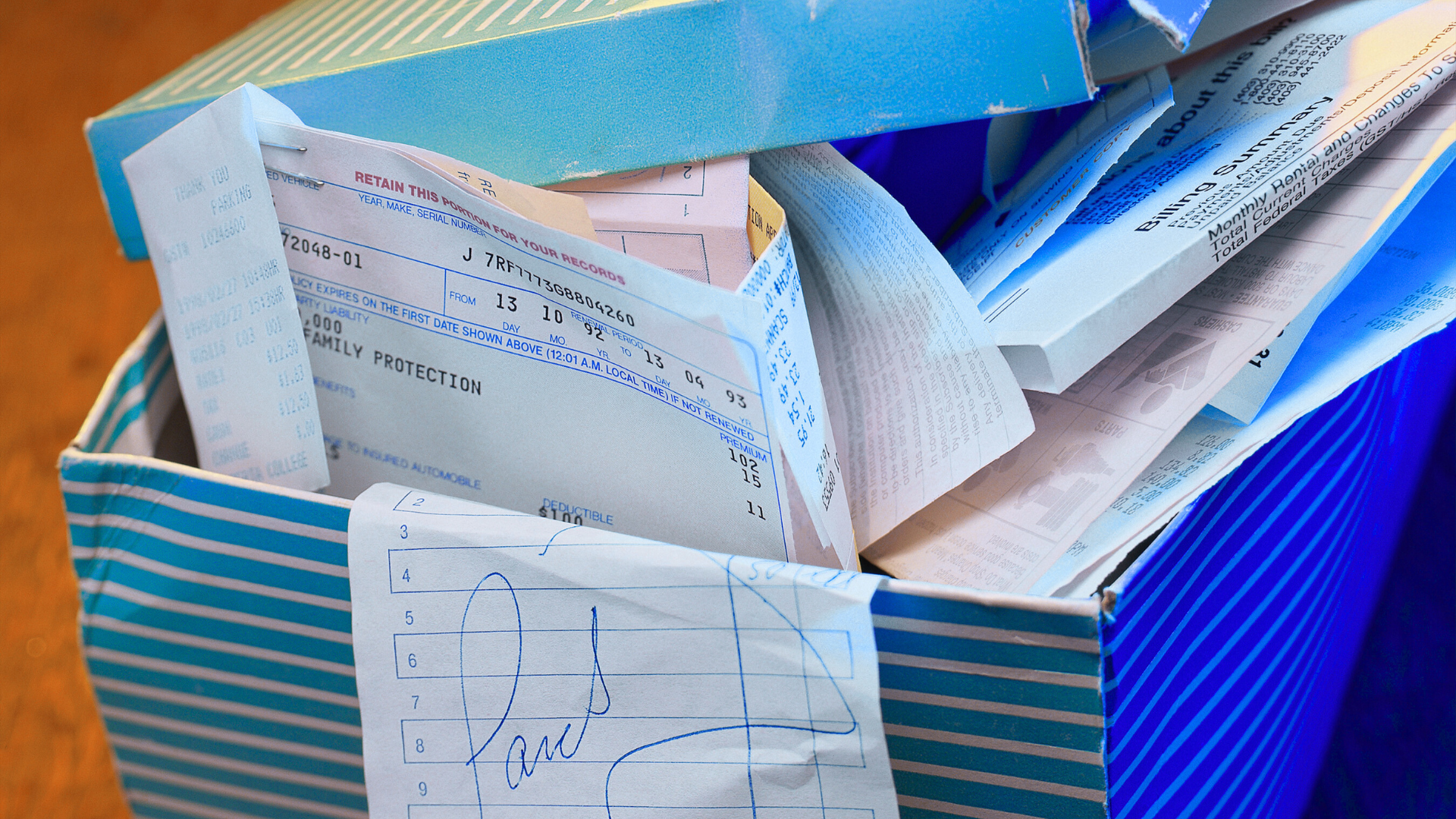

Collect All Documents: As an executor, you must collect all necessary documents, such as the last will, list of beneficiaries, financial statements, bank statements, insurance documents, receipts, invoices, loan documents, and asset list. This may take a while, and only the executor can do it.

Notify All Parties to the Estate: You must notify all interested parties – beneficiaries, creditors, and other parties with a potential claim – about your intent to file the probate and distribute the assets to maintain transparency.

Apply for Probate: You must apply to the court for a grant of probate by submitting the death certificate, a detailed inventory of the deceased’s assets and liabilities, and paying the probate fees. Once the court grants you probate, you have the legal authority to act on behalf of the deceased to settle the accounts.

An accountant is well-versed with the procedure and can help you fill in the probate application and prepare the supporting documents.

Prepare Inventory of Estate’s Assets: Once the application is submitted and interested parties notified, the executor must prepare a detailed inventory of all the assets in the estate, including real estate, jewelry, stocks, investments, financial accounts, cash, and social media accounts. Some assets may need appraising to determine their current market value.

Settle the Dues and Distribute the Assets: Once you have the inventory, the next step is to settle all dues and lawsuits using the estate’s assets. All the expenses from funeral expenses to accounting, probate, legal fees, and fees of the executor are paid using the estate’s assets. The executor will need a Clearance Certificate from the Canada Revenue Agency (CRA) confirming that no tax dues are pending.

Once all dues are settled and expenses are paid, including the executor fees, you can proceed with distributing the remainder of the estate as per the estate owner’s instructions.

This whole execution process can take 12-18 months for a simple estate. The time can extend to years if there are complexities and lawsuits.

Prepare Estate Accounting: The executor should save all the receipts and documents and record every financial transaction throughout the probate process to maintain transparency with the parties involved.

The executor might have to prepare a formal estate accounting, which will include:

- The estate’s financial position, assets, and liabilities at a point in time

- Amount received from the estate

- Amount spent to repay debt, pay taxes, and legal, administrative, and accounting expenses

- Distributions made to beneficiaries

The parties can review the account statement and raise objections, if necessary. Detailed accounting and supporting receipts and documents will protect the executor from any legal issues.

A professional accountant can help you with this. They can coordinate with other professionals and maintain meticulous records.

Exception: The executor doesn’t need to prepare formal estate accounting if there are no issues with compensation and all the beneficiaries sign the release and file it with the court. It will protect the executor from future lawsuits.

An executor’s role is not just to distribute the estate and settle the accounts, but to do so in a tax-efficient manner so that a significant portion of the estate goes to beneficiaries.

Contact DNTW Toronto LLP to Help You with Estate Planning and Execution

An accountant can help you liquidate assets in a tax-efficient manner. At DNTW Toronto LLP, our accountants and tax consultant can provide services such as tax planning, estate accounting and execution. To learn more about how DNTW Toronto LLP can provide you with the best accounting and tax expertise, reach out to us here.