Bookkeeping

How Should Small Business Owners Record and Store Business Receipts

September 4, 2025

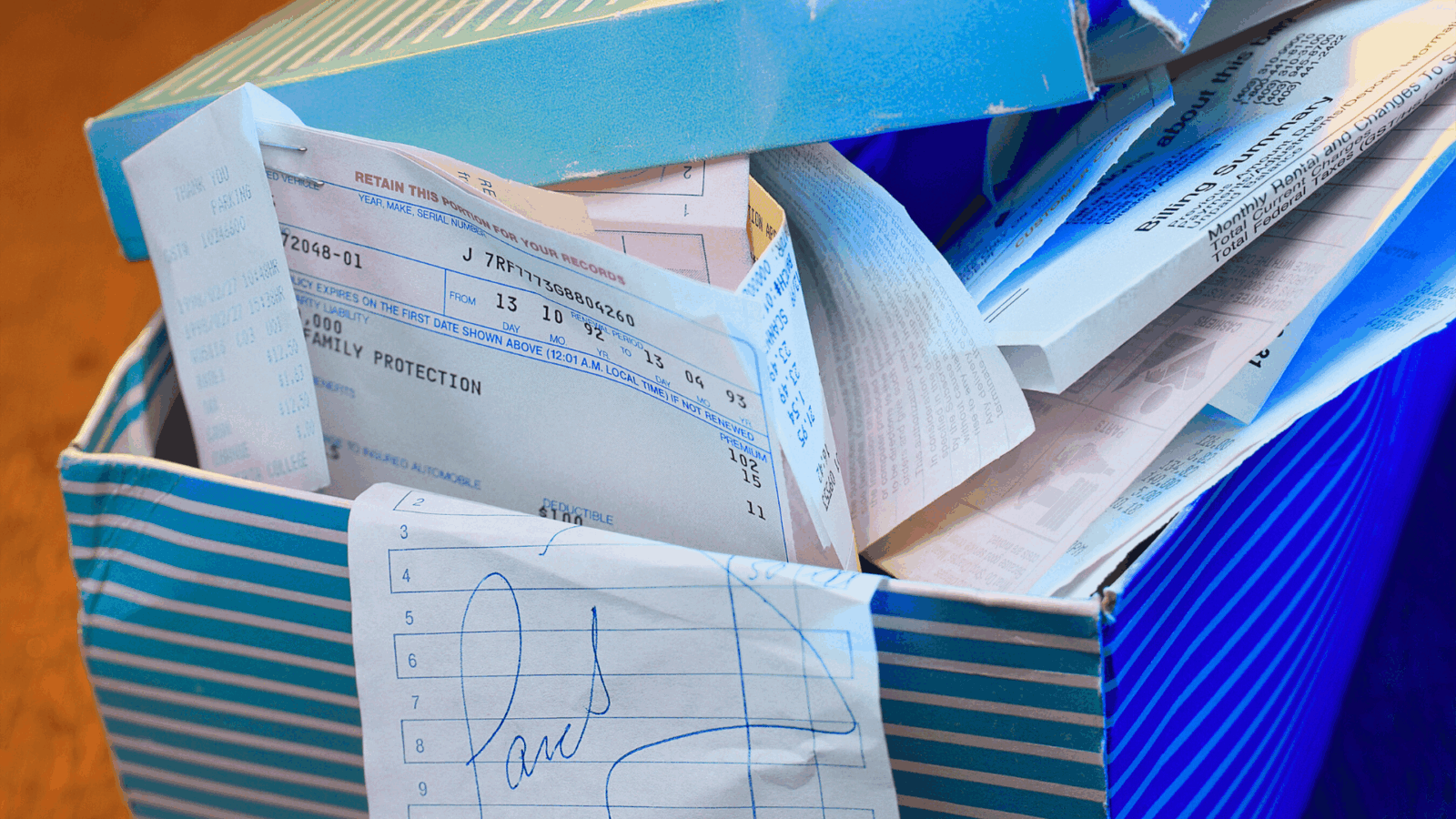

Running your own business is a fulfilling but tiring job. As if raising capital, manufacturing, strategizing, advertising, hiring, etc., weren’t hard enough, you also have to deal with the Canada Revenue Agency (CRA) and its norms, including recording business receipts. But why does the CRA assign such importance to every single business receipt?

Because every business transaction is either an income or an expenditure, which can be deducted from your taxable income, and a receipt is evidence of that transaction. Usually, high-risk taxpayers with a high volume of cash transactions, irregular cash flows, or complicated tax returns and claims are more likely to attract CRA audits. The CRA can analyze and audit your returns for the last four years after the tax assessment. Hence, it is essential to properly record and store all business receipts for at least seven years to be on the safe side.

While big corporations can afford to have a dedicated team to look into such matters, as a small business owner, the task of recording and storing receipts also falls on your shoulders.

So how does one go about managing so many receipts responsibly? Before we delve into that, let us first understand what the CRA needs in a receipt.

What Constitutes a Valid Receipt?

An admissible business receipt must have the following details on it to be considered eligible for a tax claim:

- Date of purchase

- Receipt number

- Name of the supplier and their GST number

- Amount of the purchase

- Amount of sales tax paid

- Product or service purchased

- Currency of the purchase

Lost a Receipt: Should You Be Concerned?

While nothing can replace the need for a receipt, some alternatives can work for certain expenses. In case of recurring costs such as utility bills or office stationery, one or two missing receipts won’t matter much. The CRA accepts bank statements, credit card statements, or even an estimate for such recurring costs as other receipts prove the amount is genuine. However, for a one-time purchase or cash transaction, a corresponding receipt is compulsory. If you don’t have the original receipt, try asking the vendor for a copy or replacement of the same. But if you are unable to procure one, tough luck—the CRA may not consider your claim.

Store Documents and Receipts According to Your Business Records

Business documents should help a third party, such as the CRA, trace the trail of the business transaction from where it started to where it ended. For instance, documentation and records of revenue trace the journey of the money from the signing of a contract to sending an invoice, right up to receiving the payment for the goods or services sold in your business account.

Similarly, different kinds of receipts and records help the CRA reconstruct the financial transactions of your business.

- Revenue needs to be backed by sales invoices, contracts, and bank statements.

- Any kinds of claims for office supplies, travel costs, or meal expenses will have to be substantiated with purchase invoices and expense receipts.

- Business income and expenses, as well as cash flow, will have to be proven with corresponding bank statements.

- Payroll records will have to be backed with salary slips, employment contracts, reimbursements, income tax and Canada Pension Plan remittance, and T-slips.

- Goods and services tax (GST) collected has to be supported by the invoices that state the GST collected, and documents of GST remitted.

Common Expenses Small Business Owners Can Claim

- Home office expenses: If you work from home and occupy 25% of your apartment as a home office, you can claim 25% of utility bills, condominium fees, rent, minor repairs, maintenance, and broadband from taxable income. But you need to keep those receipts organized and easily accessible, fill out Form T777 and ask the employer for a signed Form T2200.

- Capital Expense: Freelancers and gig workers can claim deductions on the capital used to buy assets used in business, such as computers, a Wi-fi router, and a software subscription. The purchase invoice and the GST paid on it can be used as documentary evidence for input tax credit and depreciation.

- Vehicle and Mileage Expenses: Many businesses use vehicles for both personal and company use. The CRA requires fuel receipts that you can use to record the mileage covered for business travel. Additionally, you need to take a photo of the car dashboard and fuel indicator before and after refuelling. You can also claim other vehicle expenses, such as maintenance and repairs, insurance, license and registration fees, and interest paid on car loans.

- Charitable Donations: If your business has donated to a qualified charity, which can issue the official charitable donation receipt, save that receipt to claim the donation deduction.

How to Organize Your Receipts

Now that you know which documents and receipts the CRA wants and why, you must have complete and valid receipts for all your transactions neatly filed, labelled, and recorded for easy access. Complete and organized records instill confidence in the business. Here is where you can start.

1. Click a Photo of the Receipt: Receipts can be in both digital and paper form. It is better to click a photo of the paper receipt to reduce the risk of ink dilution or paper damage. When taking a picture, ensure the entire receipt is visible from the first word to the last. If the receipt has more than one page, keep them side by side and cover them all in a single photo. You can also scan multiple pages in a PDF to ensure that all receipts are included in one document.

2. Label Folders and Files: Now for the tricky part, how to categorize and store the receipts so they are easily accessible. You can create folders for each month and label them “January 2025 Receipts.” In that folder, you can store all the documents from utility bills to fuel receipts to purchase invoices. When reading the business transactions, you look at the month and pull out that folder.

Name the receipt document, which is in image or PDF form, strategically. One way is to add the date, expense type, and name of the vendor so it can be searched in all three ways. For instance, “28 Mar 25_Stationary_ABC Stationery.” So if you have multiple vendors for the same expense, it will narrow down your search results.

3. Create Digital and Physical Backups: Even if you have stored it on the Cloud, keep a physical copy and a digital backup on your PC, pen drive, and accounting software.

4. Review Receipts Annually: Just like you do bank reconciliation to make sure all of your books of accounts and other financial records tally, reviewing your receipts regularly is a good business practice. This will help ensure all your tax claims are backed by proof, making any potential CRA audit or query easier to tackle. At the same time, analyzing these receipts collectively can also give you a better idea of your spending patterns, which you can then rectify if needed. In case of any missing receipts, you will have enough time to contact the vendor and request a copy.

The Convenience of Receipt Management Apps

Although this may sound overwhelming and tedious, using new-age receipt management apps and accounting software can make receipt storage and segregation much faster and more effortless. Receipt management apps and software can:

- Read your receipt using Optical Character Recognition (OCR) and extract all the vital details the CRA needs.

- Automatically enter this data into your bookkeeping system.

- Store an image of the actual receipt,

- Store a backup of all data online or in the cloud in a secure manner.

By streamlining and securing your receipts in such a manner, these apps make it easier and more cost-effective to calculate and manage reimbursement claims and tax deductions for your business expenses. They reduce the need for data entry operators and full-time bookkeepers, making it possible to consider outsourcing bookkeeping.

Contact DNTW Toronto LLP in North York to Help You with Accounting Needs

A professional accountant can help you set up receipt management software, train employees in uploading data and images, and review the records periodically to ensure all documents are being recorded accurately. At DNTW Toronto LLP, our accountants and bookkeepers offer a range of services, including document recording, ledger preparation, and bank reconciliation. To learn more about how DNTW Toronto LLP can provide you with the best accounting and bookkeeping expertise, reach out to us here.